Trump Accounts Explained: How Parents Can Jumpstart Their Child’s Retirement Savings

As a father of two boys and a CFP®, I often look for ways to give my kids a financial head start. And instead of adding more toys to the clutter pile (especially the noisy, voice-enabled ones my sister loves to give), I often encourage family members to contribute money that could benefit the boy’s financial future. Traditionally, parents like me have turned to 529 plans for college, custodial accounts for early investing, or even funding a Roth IRA once a teen begins earning income. Now, a new option is set to join the mix.

Created under the “One Big Beautiful Bill” (OBBBA), Trump Accounts are a new tax-deferred savings vehicle designed for individuals under 18. They officially launch in July 2026, and they aim to allow minors to gain a jumpstart on retirement savings and benefit from the power of compound interest.

So, let me explain some relevant details of the Trump Account:

Who is Eligible? Children under 18 with a Social Security number.

What type of account is it? It begins as a tax-deferred custodial account (managed by a parent or guardian) until the year the child turns 18, then it functions like a traditional IRA.

What can I contribute? Up to $5,000/year in after-tax contributions (indexed for inflation starting 2028). From those $5,000, employers can contribute up to $2,500/year, and that can be excluded from income if the employer’s plan meets certain requirements.

Who’s eligible for the government seed funding of $1,000? Children born between 2025 – 2028, under a pilot program.

Where will the money be invested? Limited to low-cost index funds tracking the S&P 500 or similar U.S. equity indexes (no fixed income) until the age of 18.

How will Withdrawals/Rollovers work?

o It won’t allow distribution before age 18 (with limited exceptions like disability).

o Rollovers to other Trump accounts are allowed

o Rollovers to ABLE accounts (special savings accounts for people with disabilities) are permitted in the year the beneficiary turns 17.

o After age 18, it will be treated as a traditional IRA (Early withdrawals of taxable amounts before age 59½ may be subject to a 10% penalty, unless an IRA exception applies).

What about taxes? After tax contributions (made by parents, relatives or the beneficiary) can be withdrawn tax-free, while employer contributions, government seed funding, nonprofit/government contributions, and portfolio growth will be taxed as ordinary income when withdrawn.

As with any new savings vehicle, it’s important to understand how it fits in regard to your overall financial plan before jumping in. And every account has its own strengths and limitations. Generally speaking, we identified some pros and cons that might serve as a guide:

Pros

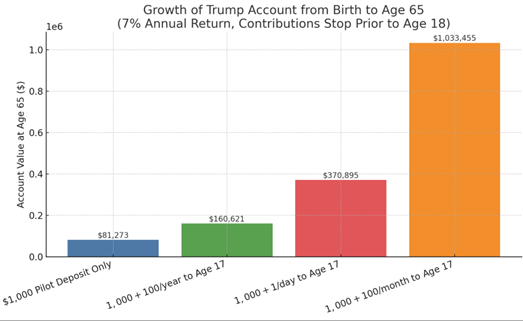

Early Compounding Potential – Starting contributions at birth means decades of growth potential (see hypothetical chart below).

No Earned Income Requirement – Unlike a traditional or Roth IRA for minors, children don’t need a job (earned income) to qualify.

Employer Participation – Employer contributions for dependents could make this an attractive employee benefit, especially for family-owned businesses.

Automatic Starter Funds – For children in the pilot program, the $1,000 federal seed can help kickstart growth without any upfront family contribution.

Low-Cost Investment Mandate – Restricting investments to low-fee index funds helps keep more of the returns in the account.

Cons

Restricted Access – Funds can’t be used before 18 (and face penalties if withdrawn before 59½ unless for an exception).

Narrow Investment Choices – Limited to certain U.S. equity index funds until age 18; no flexibility for other asset classes (limits the ability to rebalance).

Unclear Tax Details – Rules for post-18 rollovers or Roth conversions need further IRS guidance.

Impact on Benefits – Unclear whether account balances could count against eligibility for means-tested programs.

Potential Inequality – Families with more disposable income can contribute more and benefit more from compounding.

Best Uses for Parents

Retirement Head Start – If left untouched, even small contributions could grow into a meaningful nest egg. For example, starting at birth, $1 a day from birth through age 17, plus the $1,000 seed, could grow to about $400,500 by age 65.

Supplement to Other Accounts – Use alongside 529 plans for education, taxable brokerage accounts for more flexible access, and Roth IRAs once the child has earned income.

Leverage Employer Contributions – If your workplace offers the benefit, it’s essentially “free money” toward your child’s future.

Gift Alternative – Relatives can contribute instead of giving toys or short-lived items, building a lasting financial gift.

ABLE Account Planning – For families with children who qualify for an ABLE account, rolling a Trump Account at age 17 could be a strategic way to transition tax-advantaged savings into a vehicle with broader, disability-related spending options.

Source: Own elaboration using AI tools. Account growth projections are based on assumptions that may not come to pass. There is no guarantee or assurance that the projected results will be achieved or sustained. Actual results may be better or worse than the projections. Projected returns do not reflect the impact that investment expenses will have on the growth in a Trump account. Projected results do not represent the anticipated performance of Terrace Wealth or any of its advisory clients. All investment strategies have the potential for profit or loss.

Conclusion

Trump Accounts could become a valuable new tool in a family’s financial plan, particularly for parents focused on setting their children up for long-term success. While there are still unanswered questions about how they’ll integrate with traditional IRAs, Roth conversions, and tax rules after age 18, the concept of starting retirement savings at birth is powerful.

While Henry and Hunter may only end up with 20 monster trucks each, I hope that by being intentional and proactive with their savings, they’ll also gain an early appreciation for the 8th wonder of the world: compound interest.

As with any planning tool, the key is understanding how it fits with your broader goals, including college funding, your own retirement plan, and other estate considerations. At Terrace Wealth, we’re tracking developments closely. Want to see how Trump accounts could fit into your family’s financial plan? Schedule a free consultation with Terrace Wealth.

Frequently Asked Questions (FAQ)

When must your children be born to receive this seed funding from the government?

Children must be U.S. citizens born between 01/01/2025 and 12/31/2028. The $1,000 will be automatically deposited into their Trump Account under the pilot program.

Can my kid use this account for funding college?

Yes, but not until age 18. At that point, Trump Accounts follow IRA rules. Withdrawals for qualified education expenses (tuition, fees, books, supplies if at least half-time) can be made without the 10% early withdrawal penalty. You’ll still owe ordinary income tax on growth, employer contributions, and government seed money, but the portion you (or family) contributed after tax will always come out tax-free.

Can I, as a guardian, withdraw money before the child turns 18 in case of an emergency?

No. Withdrawals are not allowed before the child turns 18, except in very limited cases, such as rolling the account into an ABLE account for children with disabilities in the calendar year the child turns 17.

What is the maximum amount I can contribute as a parent per year?

Parents (and relatives) can contribute up to $5,000 per year per child, starting in July 2026. This is separate from your own IRA contribution limits.

Can my employer contribute?

Yes. Employers can put in up to $2,500 per year into Trump Accounts for their employees’ dependent children. These contributions don’t count as taxable income to you but will count against your $5,000 contribution limit.

Will my kid pay taxes when withdrawing the money?

Your contributions come out tax-free after age 18.

Government seed money, employer contributions, and investment growth are taxed as ordinary income when withdrawn.

If withdrawals happen before age 59½ and aren’t for an exception (like education or a first home), a 10% penalty may also apply.

Sources:

Kitces, Michael. Breaking Down The “One Big Beautiful Bill Act” (OBBBA): Tax Planning Implications For SALT Cap, Senior Deduction, QBI Deduction, And Trump Accounts. Kitces.com, July 19, 2024. Website link

Mercer. Employers Can Contribute to Trump Accounts Starting Next July. Mercer Insights, July 22, 2024. Website link

U.S. Congress. One Big Beautiful Bill Act, Public Law 119-21, July 3, 2024. Website link

Footnotes:

Chat GPT was used to generate images, create charts, and to site sources. Grammarly was used for flow.

Terrace Wealth, LLC is registered as an investment adviser with the state of Missouri. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators nor does it indicate that the adviser has attained a particular level of skill or ability. The firm is not engaged in the practice of law or accounting.

Tax and legal information provided is general in nature and should not be viewed as tax or legal advice. Always consult an attorney or tax professional regarding your specific legal or tax situation. IRA, as well as tax rules and regulations, are subject to change at any time.