What No One Tells You About Target Date Funds

Target Date Funds (TDFs) have been around for 30 years in the market, and today more than 36 million Americans invest in them, primarily through their 401(k)(1). Before they were introduced, 401(k) savers needed to choose between some available strategies, primarily through Mutual Funds and stable value funds. The arrival of TDFs has revolutionized the industry, helping millions invest in diversified, risk-appropriate portfolios for their retirement funds. Today, these instruments account for around 70% of Qualified Default Investment Alternatives (QDIA) in US 401(k) plans, which means TDFs are the default investment option in your retirement plan and automatically receive your contributions.

In this post, we will explain what a Target Date Fund is, how it works, and the main benefits. We will also explore some drawbacks that researchers have identified in these investments and how, at Terrace Wealth, we can help you maximize the benefits of your retirement plan when we have an understanding of your entire financial picture.

What are Target Date Funds?

Target Date Funds are an all-in-one investment vehicle, primarily offered in retirement plans, that enable the investor to choose an investment based on his or her expected retirement date. The funds will have an appropriate mix of stocks, bonds, and sometimes alternative asset classes based on the providers "glide path”. The main idea is that the fund becomes more conservative as the retirement date approaches, allowing investors to be hands-off with their funds. For example, imagine that, given your age, you'd be expected to retire in 2060, and therefore, you'd be placed in a 2060 TDF. Because your retirement is decades away, the fund would hold a higher allocation to stocks, focusing more on long-term growth. Meanwhile, a 2030 TDF, which is for someone expected to retire in 5 years, would hold a higher allocation to bonds to reduce portfolio risk as retirement approaches.

What are the main benefits of Target Date Funds?

Target Date Funds have many benefits, and Christine Benz from Morningstar describes these very well (2):

Investor hands-off approach: Allow investors to be placed in an age-appropriate asset mix and make trading unnecessary. The portfolio will become less risky over time as retirement approaches. TDFs also apply rebalancing strategies that will be time-consuming (and often hard) for investors.

Cost-effective: Most of the target funds offer their products at very low costs. According to the same article from Morningstar, the average asset-weighted fee has been reduced by almost half since 2009, and in 2024 was around 0.29% per year, making TDFs a highly competitive financial product.

What are the limitations and drawbacks of Target Date Funds?

Even though we appreciate the value and the significant positive outcome that TDFs have provided to most of the American population, some caveats are worth mentioning:

One solution fits all: We appreciate the path to reducing risk, moving to a more conservative portfolio as the day of retirement approaches. This solution might be suitable for most investors when looking for an easy, hands-off alternative. However, as investors start to have more complex needs and goals, the allocation provided by target funds might not be the most optimal for them; that allocation may require either more or less risk depending on their financial situation and other assets in place.

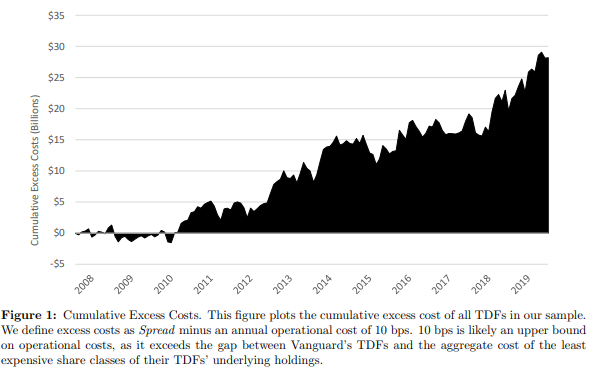

Lack of benchmark and excess cost paid by investors: In a recent paper published by professors Brown and Davis (2024)(3), they created Replicating Funds (RFs) to calculate TDF's performance against benchmarks they built using low-cost Exchange Traded Funds (ETFs). These researchers found that TDFs underperformed by around 1% per year (against those benchmarks), with roughly half of the underperformance stemming from fees and the other half from the active management in their funds. Also, they estimated the potential excess cost between 2008 and 2019 to be about $28 billion, including approximately $8.6 billion in 2019 alone (more details in Figure 1).

Figure 1: Cumulative Excess Cost between 2008-2019

Source: Off Target: On the Underperformance of Target-Date Funds, Brown, Davies (2024)

Glide paths might differ significantly among different providers of funds: The definition of glide path is the strategy that gradually shifts the asset allocation from higher-risk (like stocks) to lower-risk (like bonds) as the target retirement date approaches. Nevertheless, each family of funds might have a different glide path for the same retirement year. Using data from Morningstar’s 2025 Target Date Landscape report (4), Figure 2 illustrates how glide paths have taken on more risk over the past 15 years. Figure 3 shows how equity allocations vary widely among same-year TDFs from different providers, highlighting the significant disparity in portfolio risk depending on the chosen provider. In practical terms, this means every fund will have a unique strategy, and some might be more aggressive than others; investors may not be fully aware of these differences.

Figure 2: Average Asset Allocation Glide Path Over time

Source: Morningstar - 2025 Target-Date Fund Landscape, p-24.

Figure 3: Minimum, Maximum, and Average Glide Path - 2024

Source: Morningstar - 2025 Target-Date Fund Landscape, p-26

Not all TDFs are equal. Who manages your money matters: Brown and Davis (2024) documented the variation in performance across different TDFs and found an average difference between the 10th and 90th percentile of 5.18% per year. That means if you had invested $100,000 in one of the bottoms 10% performing funds, you could have missed out on around $5,000 per year during a bull market, compared to being in one of the top 10% performing funds.

Conclusion

We acknowledge the important role these funds have played in making investing more accessible. TDFs offer a simple, hands-off option for those who do not have the time or interest to actively manage their portfolio or the guidance of a financial professional. However, as your wealth grows and your financial situation becomes more complex, it becomes important to take a more holistic approach by evaluating your entire financial picture to determine the best strategy for investing in your 401(k).

Every client's situation is different, and, at Terrace Wealth, we may or may not recommend a particular TDF in your allocation for your 401(k). However, understanding your goals and perspectives will enable us to select a mix of assets that better aligns with your unique circumstances.

Finally, remember that any decision you'll make now will have a lasting impact on your financial plan, and every small step in the right direction can compound over time. At Terrace Wealth, we are here to help you get the best out of your plan and investments. Even small percentage differences can have a big impact. As the father of value investing, Benjamin Graham, said, “The magic of compounding returns is the most significant mathematical discovery of all time.” Over time, those seemingly minor gains can grow into a significant advantage.

Sources

(1) 30 years of LifePath® target date funds - BlackRock https://www.blackrock.com/us/financial-professionals/practice-management/defined-contribution/insights/lifepath-target-date-fund-history

(2) Brown, David C. and Davies, Shaun, Off Target: On the Underperformance of Target-Date Funds * (2024). Available at SSRN: https://ssrn.com/abstract=3707755

(3) Are Target Date Funds Good Investments? – Morningstar https://www.morningstar.com/funds/are-target-date-funds-good-investments

(4) 2025 Target-Date Fund Landscape - Morningstar

Footnotes:

Grammarly was used for flow.

Terrace Wealth, LLC is registered as an investment adviser with the state of Missouri and Wisconsin. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators nor does it indicate that the adviser has attained a particular level of skill or ability. The firm is not engaged in the practice of law or accounting.

Past performance is not indicative of, and does not guarantee, future results. All investments involve risk, including the possible loss of principal. Future returns are not guaranteed, and actual outcomes may differ materially from projections or expectations. Investors should carefully consider their objectives, risk tolerance, and financial situation before making any investment decisions.

Tax and legal information provided is general in nature and should not be viewed as tax or legal advice. Always consult an attorney or tax professional regarding your specific legal or tax situation. IRA, as well as tax rules and regulations, are subject to change at any time.