Open Enrollment Is Coming: How to Make the Most of Your 2025 Benefits Season

Every fall, millions of employees face one of the most important financial windows of the year: open enrollment. It’s the short period when you can review, change, or start benefits such as health insurance, retirement contributions, and other workplace plans that can meaningfully impact your financial well-being.

Most people spend only 18 minutes reviewing their open enrollment options, far less than they spend planning a weekend getaway. Yet these decisions shape everything from healthcare costs to retirement savings for the next twelve months and beyond.

We hosted a webinar (see the full webinar here) about how to make the most out of benefits and we here we provide a summary to help you make smarter, more confident choices during open enrollment.

Understanding Open Enrollment

Open enrollment is your annual opportunity to adjust your employer benefits for the upcoming year. Outside this period, most changes are allowed only with a qualifying life event (marriage, birth or adoption, move, or loss of coverage).

But open enrollment isn’t just about health insurance. It’s also the time to:

Review your 401(k) or 403(b) contributions (pre-tax or Roth)

Set HSA or FSA amounts

Adjust life, disability, dental, and vision coverage

Explore voluntary or supplemental benefits

These choices directly influence your financial plan, cash flow, and even your tax strategy for the coming year.

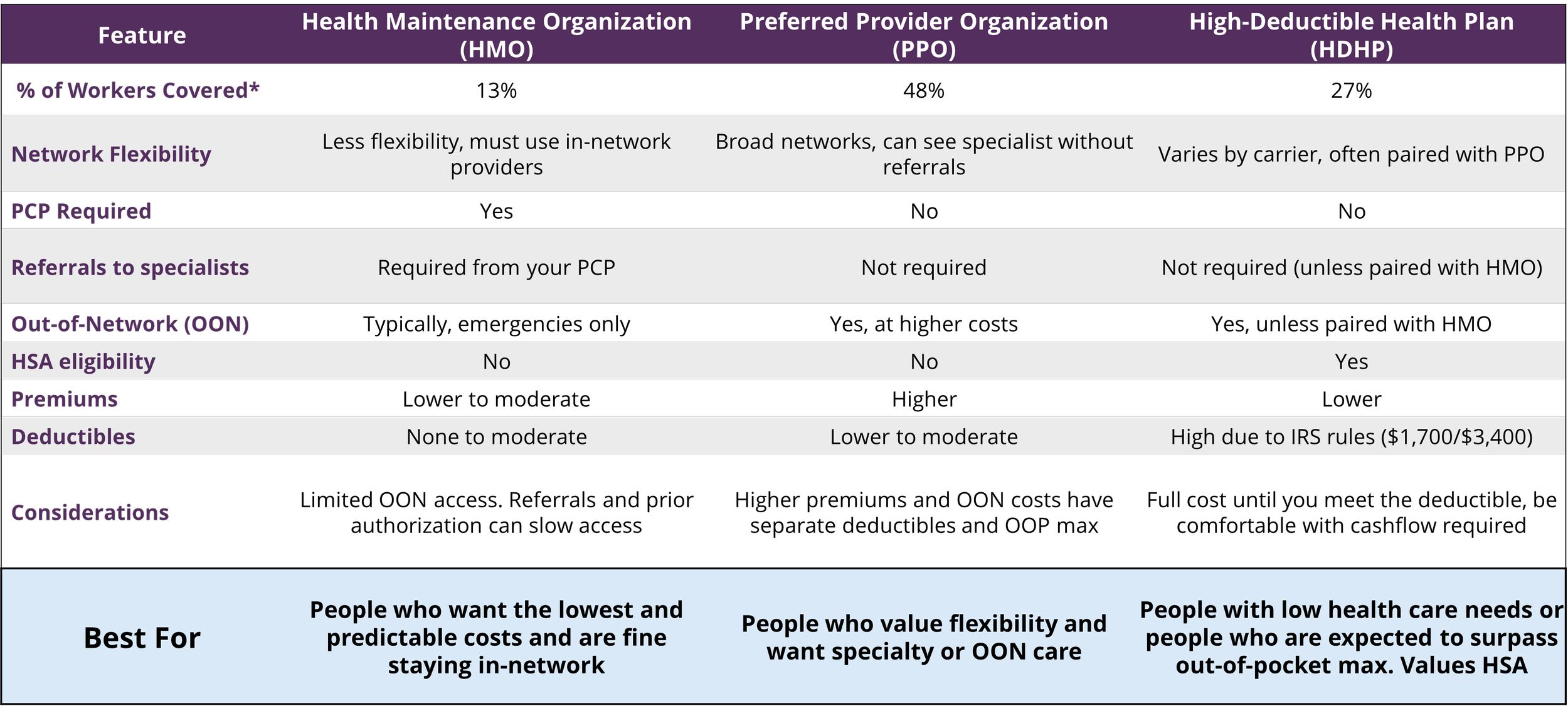

1. Health Care: Choose Wisely for Your Needs

Healthcare coverage is often the most complex part of open enrollment. Here’s a quick guide to the three main types:

HMO (Health Maintenance Organization)

Lower premiums, but in-network only and requires a primary care doctor/referrals.

Best for employees who prefer predictable costs and a smaller provider network.

PPO (Preferred Provider Organization)

Flexible — no referrals required, and often includes out-of-network options.

Premiums are higher, but so is convenience and choice.

HDHP (High Deductible Health Plan)

Lowest premiums and access to a Health Savings Account (HSA).

Best for those with either very low or very predictable medical expenses, and for those who expect to reach the out-of-pocket max.

Source: Own Elaboration. *KFF. (2024). 2024 Employer Health Benefits Survey. Kaiser Family Foundation

HSA vs. FSA: Which One Fits You?

We consider HSAs the “unicorn of tax savings”, combining deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. Below we provide a table to explain each account and how they work.

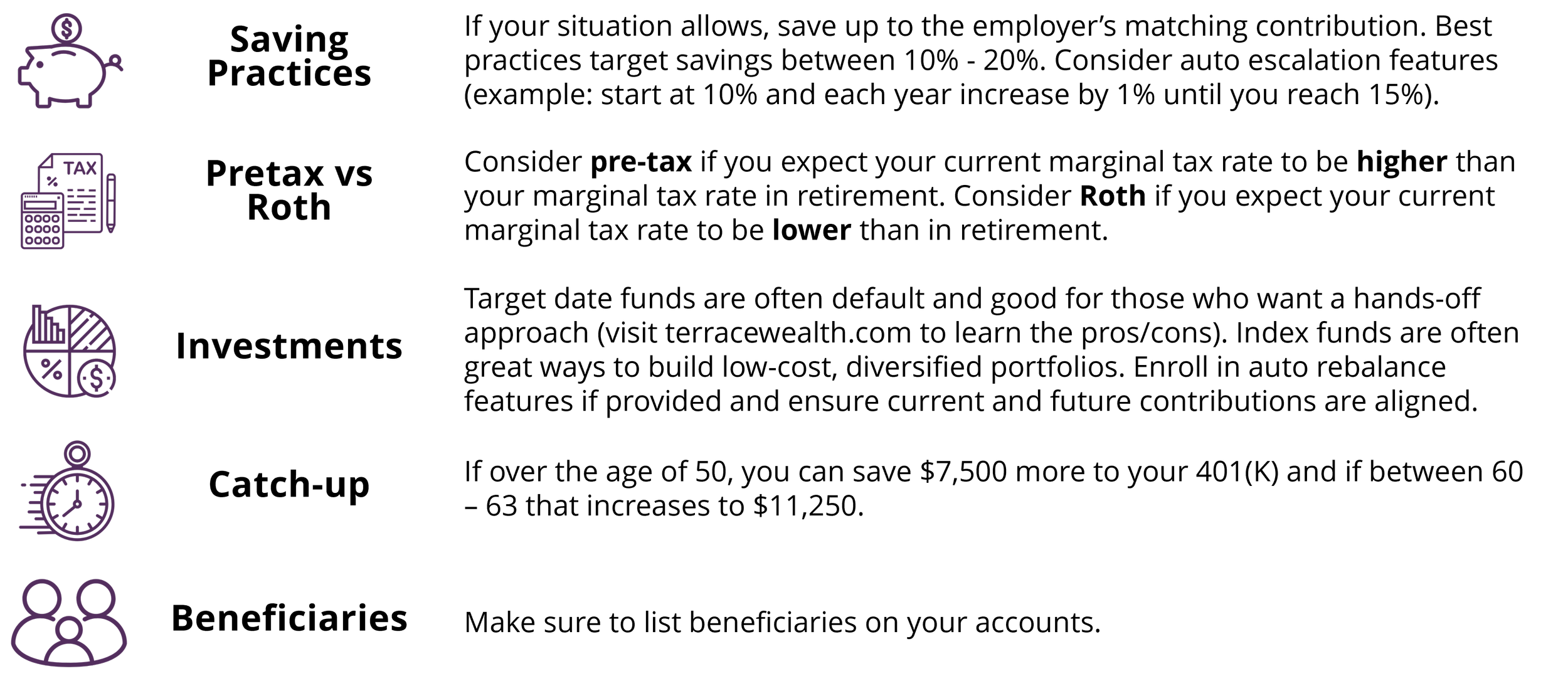

2. Retirement: Revisit Your Long-Term Strategy

Open enrollment is a great moment to check your retirement trajectory, and maybe even bump your savings rate.

Contribution Limits for 2025

$23,500 employee deferral

$7,500 catch-up (50+)

$11,250 enhanced catch-up (ages 60–63)

Best Practices

· Contribute enough to get the full employer match

· Save 10–20% of your salary if possible

· Turn on auto-escalation (increase savings 1% per year)

· Choose pre-tax or Roth based on your future tax expectations

· Review your beneficiaries — one of the simplest and most overlooked steps

If you want to know more, below we provide a more extensive explanation.

3. Insurance: Protecting What Matters

Life and AD&D

Employer-provided life insurance often covers one year of salary, with optional employee-paid supplemental coverage up to 5× salary. If you’re young and healthy, you may find individual term life insurance offers more coverage at a lower cost over time.

Disability Insurance

Short-term (1–2 weeks waiting period): covers income for several months.

Long-term (90–180 days waiting period): covers 60% of income, sometimes to retirement.

Long-term disability is one of the most undervalued yet crucial protections available.

4. Additional Benefits: Hidden Gems in Your Package

We recommend taking the time to review your benefits package carefully, you might uncover a few hidden gems. Some options may not seem significant at first, but they can still help you save money, whether through lower expenses or valuable tax advantages. Here are a few of the highlights we discussed:

Dental & Vision

Affordable, valuable, and worth keeping — particularly for families.

Dependent Care FSA

Contribute up to $5,000 pre-tax for childcare, preschool, summer camp, or adult day care.

Other Add-Ons

Accident, critical illness, or hospital indemnity coverage

Wellness or gym memberships

Legal and identity protection plans

5. Your Open Enrollment Checklist

· Block 30–45 minutes to review benefits

· Estimate next year’s healthcare and childcare costs

· Review or increase your retirement contribution

· Evaluate insurance needs (life, disability, supplemental)

· Confirm your beneficiaries

· Use your HSA/FSA strategically

· Ask your advisor for guidance

Final Thoughts

This year, take a little extra time to understand your benefits package instead of treating it as just 18 minutes of paperwork. Open enrollment is more than a formality, it’s an opportunity to strengthen your financial resilience and gain a clearer view of your overall financial picture for the year ahead.

As we mentioned at the webinar: “These decisions shape your healthcare, savings, and protection for the entire next year. Taking the time now pays dividends later.”

Do you want to explore a discovery meeting with us?

📅 Schedule a complimentary discovery meeting at www.terracewealth.com/contact

📧 Or email us at info@terracewealth.com

Footnotes:

This post was created with the assistance of ChatGPT using our webinar as a reference and refined by the authors.

Disclaimer

This webinar and blog post are provided for educational and informational purposes only. It should not be considered investment, legal, or tax advice, nor does it create an advisory relationship. The views expressed are those of the presenters and do not necessarily reflect the official position of Terrace Wealth. Participants should not act upon the information presented without first seeking professional advice that considers their specific situation. Investments involve risk, including the possible loss of principal.

Terrace Wealth is registered as an investment adviser with the state of Missouri and Wisconsin. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators nor does it indicate that the adviser has attained a particular level of skill or ability.

The firm is not engaged in the practice of law or accounting. Estate planning, tax and legal information provided is general in nature and should not be viewed as tax or legal advice. Always consult an attorney or tax professional regarding your specific legal or tax situation.

This overview of our services and strategies should not be regarded as a complete analysis of the subjects discussed. Content should not be viewed as personalized investment advice. Information presented is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities discussed. You should consult with a professional advisor before implementing any of these strategies